(Bloomberg) — BP Plc raised its dividend and promised to purchase again extra shares, capping a second-quarter earnings season that has seen Massive Oil proceed to prioritize returns for buyers.

Most Learn from Bloomberg

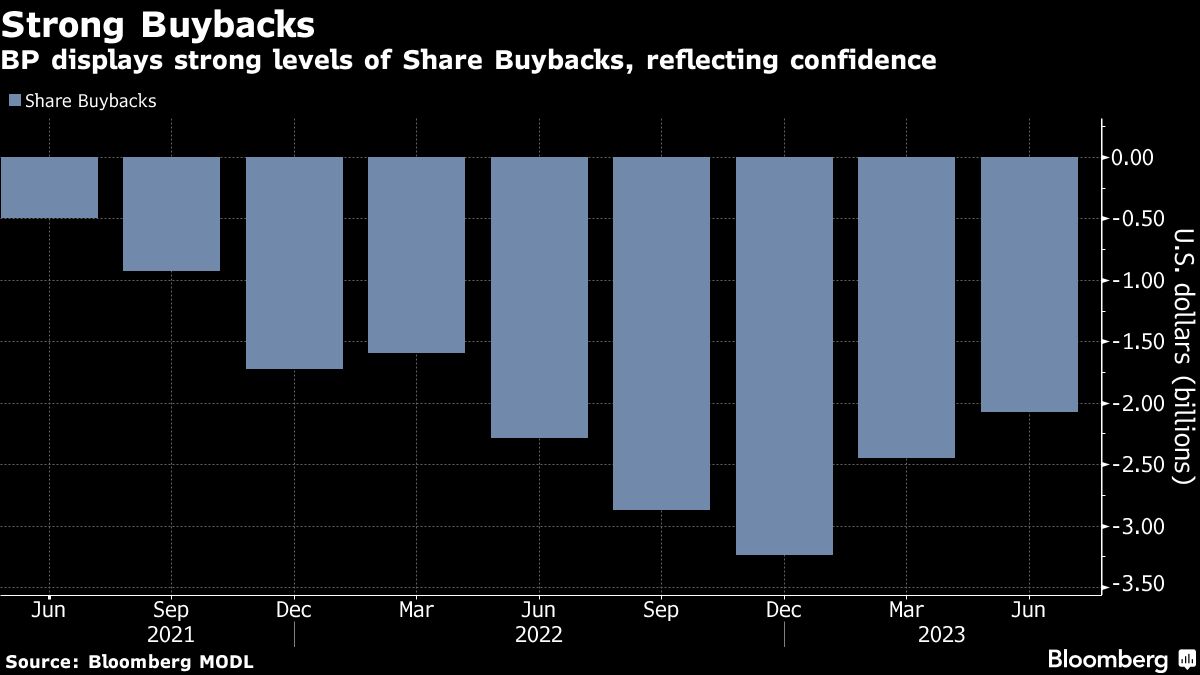

The London-based firm raised its dividend by 10% and mentioned it might purchase again one other $1.5 billion in shares, at the same time as its dividend fell greater than anticipated. It was following a sample set by Shell plc, Complete Vitality SE, ExxonMobil Corp. and Chevron Corp., all of which stored cash flowing to their shareholders even because the rise in power costs that spurred final 12 months’s file earnings eased.

BP’s income has now considerably exceeded the corporate’s steering. It had indicated earlier that it anticipated to purchase again about $4 billion in shares and lift the dividend by 4% annually, assuming the value of Brent crude was round $60 a barrel. Over the previous 4 quarters, the corporate has purchased again $10 billion in inventory and elevated its dividend by a fifth.

“That is shocking given the weaker core consequence and the rise in internet debt,” Redburn analyst Stuart Joyner mentioned in a notice on Tuesday. “However with the sector buying and selling more and more on yield once more, that would enhance shares this morning.”

Shares of the corporate have been up 1.51% at 490.30p as of 9:11 am in London.

These large money funds have drawn some criticism at a time when many nations are grappling with a cost-of-living disaster and the world wants big quantities of funding in low-carbon power to sort out local weather change. BP has pledged to extend spending on each oil and fuel and renewable power.

BP’s adjusted internet revenue within the second quarter was $2.59 billion, down from $8.45 billion a 12 months earlier and fewer than the typical analyst estimate of $3.51 billion.

“The failure is in refining,” CEO Bernard Looney mentioned in an interview with Bloomberg. “Margins have been very skinny, significantly in diesel” in Europe and on the Whiting refinery within the US.

Looney mentioned BP “did quite a lot of the upkeep that we deliberate to do within the quarter” and oil buying and selling earnings have been weaker.

The buyback and dividend improve on the again of weak earnings had an vital facet impact – elevated debt. Web debt elevated by greater than $2 billion from the earlier quarter to $23.7 billion, although that is nonetheless a lot lower than it was a couple of years in the past.

BP is sticking to its $16 billion to $18 billion capital spending plan this 12 months. He is spent $7.9 billion to date, which places him on monitor to succeed in the decrease finish of that vary.

“BP’s 10% dividend improve and $1.5 billion buyback tranche for the third quarter (versus $1.75 billion within the second quarter) are optimistic surprises that may enhance confidence in second half funds.” Will Harris, BI International Vitality Analyst

Fuel buying and selling had one other “distinctive” quarter, Looney mentioned in an interview with Bloomberg TV, although earnings have been down barely from the primary three months of the 12 months attributable to decrease volatility. He mentioned Europe’s fuel market appears set to be in a greater place subsequent winter, though the area is “not out of the woods but”.

Looney mentioned oil demand has been “extremely resilient” and OPEC+ is sticking to its pledged manufacturing cuts, giving a strong outlook for crude costs within the months forward.

– With assist from Will Kennedy.

Most Learn from Bloomberg Businessweek

© 2023 Bloomberg LP