(Bloomberg) — The U.S. Treasury Division this week is about to start ramping up issuance of long-term securities that may probably prolong into subsequent 12 months, pushed by a quickly deteriorating finances deficit and rising rates of interest.

Most Learn from Bloomberg

For the primary time since early 2021, the Treasury Division will increase its so-called quarterly refund of long-term Treasury notes, to $102 billion from $96 billion, in keeping with the consensus of sellers. Whereas it’s down from the file ranges set through the Covid-19 disaster, that is effectively above pre-pandemic ranges.

Wednesday’s announcement can be prone to see debt managers elevate common public sale volumes of securities throughout the yield curve – with attainable exceptions or smaller bumps for less-demanding notes. Merchants shall be watching individually for an replace on an upcoming program to purchase again previous Treasury notes.

Public borrowing wants are rising thanks partially to the Federal Reserve’s rate of interest hike, which raised its coverage benchmark to a 22-year excessive — which in flip raises yields on authorities debt, making it costlier. The Fed can be decreasing its holdings of Treasury notes, forcing the federal government to promote extra of them to different consumers. All of this will increase the danger of higher volatility when the federal government bids on its securities.

“There’s a variety of provide coming in. We had been shocked by the deficit numbers, that are life like,” mentioned Mark Cabana, head of US rate of interest technique at Financial institution of America Corp.

Bigger quantities of debt issuance haven’t immediately translated into decrease charges and better yields, as US debt inflation has been seen alongside traditionally low yields over the previous twenty years. However giant public sale volumes contribute to the potential for short-term volatility, at a time when banks’ market-making urge for food is waning. That was up for a seven-year public sale on Thursday that noticed consumers ask for an even bigger low cost to soak up the securities.

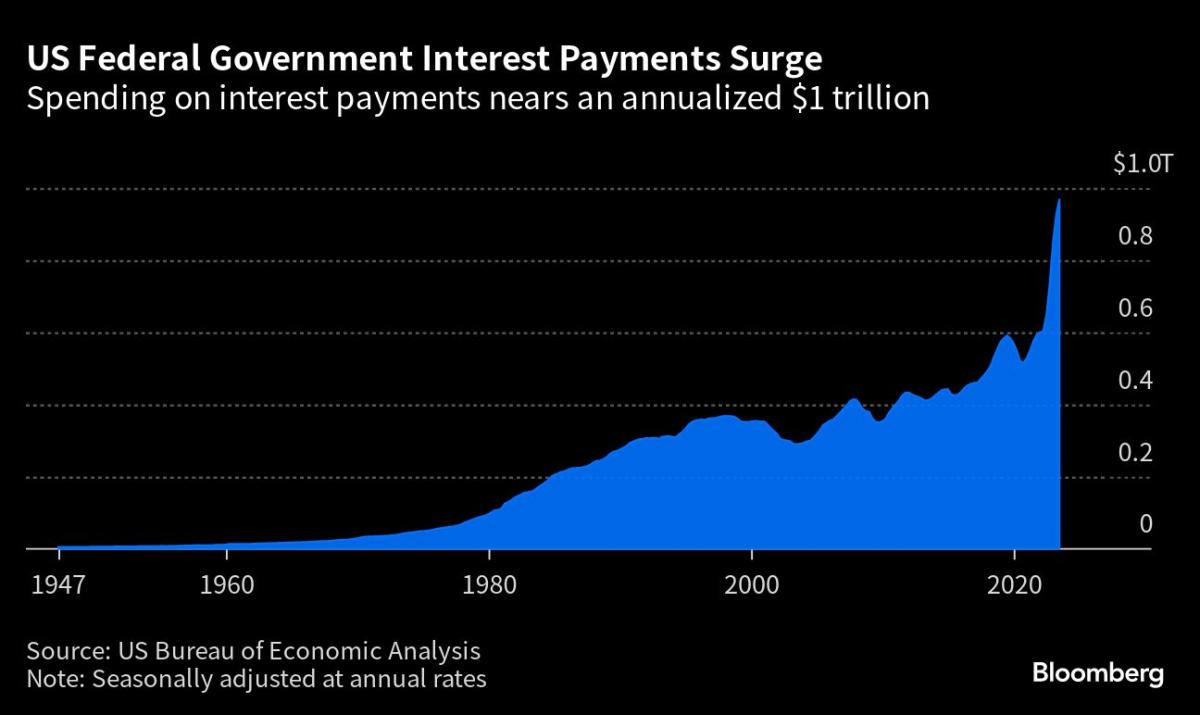

What drove up yields had been greater federal rates of interest and inflation, a key dynamic issue widening the finances deficit. The price of servicing US authorities debt jumped 25% within the first 9 months of the fiscal 12 months, to $652 billion — a part of a world phenomenon driving public borrowing.

Learn extra: US $652 billion in debt prices as costs hit 11-year excessive

Cabana and his crew projected that the Treasury would enhance gross sales of coupon debt — as notes that pay curiosity are identified — not simply this month, however once more in debt administration coverage bulletins in November and February.

The consensus of service provider expectations exhibits the next for upcoming redemption auctions:

-

$42 billion in 3-year bonds on Aug. 8

-

$37 billion in 10-year bonds on Aug. 9

-

$23 billion in 30-year bonds on Aug. 10

Together with these gross sales, most merchants see a rise in issuance throughout most maturities within the $2 billion clip every, with many seeing smaller will increase within the 7- and 20-year Treasuries, which have seen bouts of weak demand.

Some merchants count on that the 20-year bond shall be singled out and not using a change in quantity. The safety has been tormented by poor pricing and liquidity because the Treasury Division relaunched it in 2020.

“There needs to be well-distributed will increase throughout the curve,” mentioned Subhadra Rajappa, head of US rate of interest technique at Societe Generale SA, together with barely smaller will increase for 7- and 20-year debt. “It is a one-way course now for deficits over the subsequent 10 years, with deficits getting larger. The Treasury needs to ensure it is effectively funded for the subsequent a number of years.”

The federal deficit was $1.39 trillion for the primary 9 months of the present fiscal 12 months, up about 170% from the identical interval a 12 months earlier, highlighting the Treasury Division’s rising funding wants. On Monday, the division boosted its forecast for borrowing within the July-September quarter to $1 trillion, from the $733 billion it set in early Might.

Learn extra: US Treasury boosts quarterly borrowing estimate to $1 trillion

What Bloomberg Intelligence says…

Treasury coupon issuance could also be slowly elevated over the subsequent six months.

“Voucher auctions might go up by $1 billion throughout the curve in August, with month-to-month auctions rising by a further $1 billion every month by way of January.”

— Ira F. Jersey and Will Hoffman, Strategists B

Click on right here to learn the total report

In the meantime, the Fed is decreasing its holdings of Treasury securities by as much as $60 billion a month, by letting the securities mature with out changing them. Fed Chairman Jerome Powell additionally famous final week that portfolio runoff might proceed at a sure tempo even after policymakers begin slicing rates of interest, suggesting a longer-than-many-think interval of the so-called quantitative-tightening program.

One other dynamic that treasury managers should take into account is the share of bonds, maturing in short-term durations of as much as a 12 months, in whole excellent debt. The Treasury Borrowing Advisory Committee, a panel of market members together with consumers and merchants, has lengthy suggested a variety of 15% to twenty% for this ratio.

The Treasury Division lately bought off a slew of notes because it sought to rebuild its money steadiness within the wake of falling to dangerously low ranges through the partisan battle over the debt restrict earlier this 12 months.

Citigroup Inc. mentioned: Treasuries goal share shall be among the many issues they’re searching for this week.

Invoices and buybacks

“The Treasury must materially enhance public sale volumes in returning funds for November and February,” mentioned Jabaz Maathai of Citigroup, head of G10 charge technique, in a word to shoppers. He added that will increase within the fourth quarter are set to be “sooner than the post-Covid launch cycle”.

One other merchandise to look at is any replace on the Treasury’s buyback plans, which had been first revealed in Might after months of consideration. One of many objectives of shopping for again previous securities and issuing extra present ones is to assist promote erratic liquidity within the Treasury market. One other approach to mitigate volatility is in its issuance of treasury payments.

This system is about to begin subsequent 12 months, however merchants see the Treasury continues to be understanding the main points. The division queried them once more within the advance redemption survey questions.

Learn extra: Treasury Asks Sellers on Public sale Quantity Development and Buyback Design

— With help from Victoria Dandrino, Alex Tanzi, and Elizabeth Stanton.

(Updates with the quarterly borrowing estimate, within the first paragraph after the second chart.)

Most Learn from Bloomberg Businessweek

© 2023 Bloomberg LP