(Bloomberg) — Outstanding economists Larry Summers and Mohamed El-Erian have joined a gaggle of their friends in criticizing Fitch Rankings’ resolution to downgrade america given indicators of resilience on this planet’s largest financial system.

Most Learn from Bloomberg

Former Treasury Secretary Summers mentioned that whereas there are causes to be involved concerning the long-term trajectory of the US deficit, the nation’s potential to service its debt has by no means been in query. El-Erian, chief financial advisor to Allianz SE, mentioned the downgrade was an “unique transfer” that was unlikely to have an effect on the markets.

“The notion that this results in default threat in US Treasuries is absurd, and I do not suppose Fitch has any new and helpful insights into the state of affairs,” Summers mentioned in a telephone interview. “If something, the information previously two months means that the financial system is stronger than folks suppose, which is sweet for the creditworthiness of US debt.”

“I can not think about any severe credit score analyst would give that weight,” mentioned Summers, a Harvard professor and paid contributor to Bloomberg Tv.

financial shocks

Fitch downgraded america one step to AA+ from AAA, saying tax cuts and new spending initiatives together with a lot of financial shocks have pushed up the finances deficit. The transfer comes on the heels of S&P World Rankings’ resolution to downgrade america from the very best stage in 2011, and leaves Moody’s Buyers Service as the one main scores company preserving the nation at its highest ranges.

Learn extra: US stripped of AAA ranking by Fitch as finances deficit swells

“The downgrade of the US credit standing displays the anticipated monetary deterioration over the subsequent three years, the excessive and rising total authorities debt burden, and the erosion of governance relative to AA and AAA rated friends over the previous 20 years,” Fitch mentioned in an announcement.

This erosion of governance, the scores agency mentioned, “has manifested itself in frequent debt restrict confrontations and last-minute selections.”

Even with the bipartisan settlement to droop the US debt ceiling reached in early June, Fitch analysts write, there was a gradual deterioration in governance requirements on fiscal and debt points over the previous 20 years and restricted progress in coping with rising welfare prices. .

The US debt burden will attain 118% of GDP by 2025 — two and a half instances greater than the AAA common of 39%, in accordance with Fitch, which forecasts the debt-to-GDP ratio. It is going to rise additional in the long run, rising America’s vulnerability to future financial shocks.

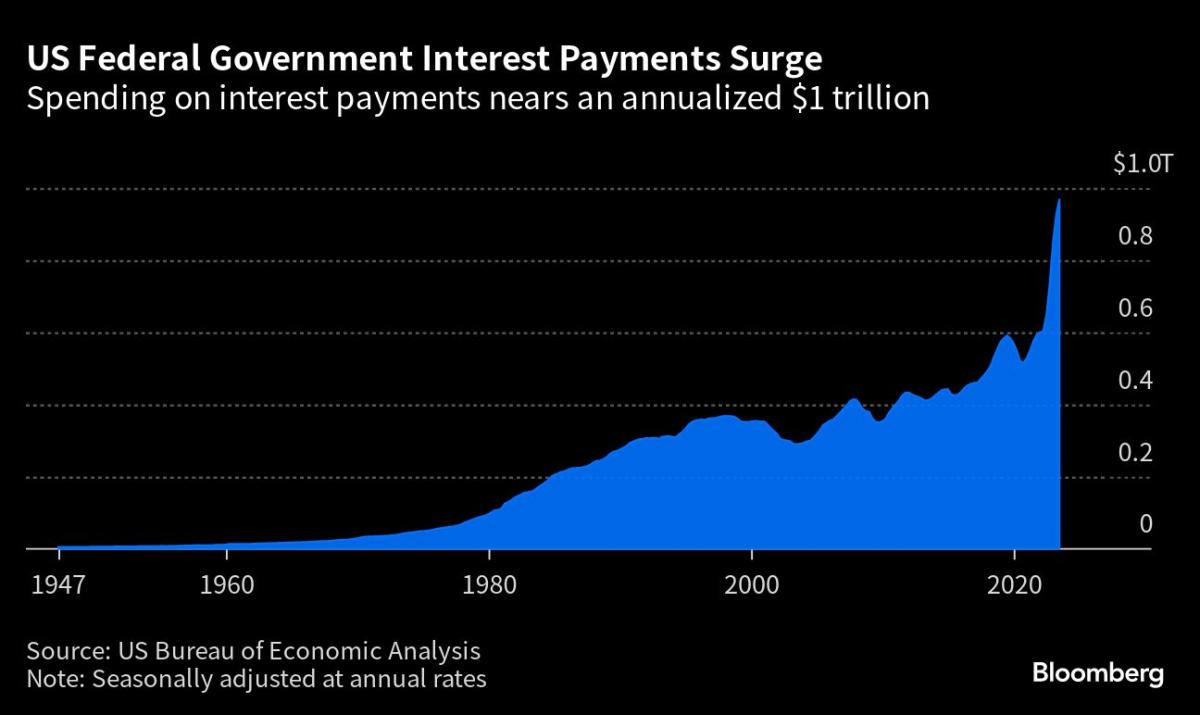

The federal deficit was $1.39 trillion within the first 9 months of the present fiscal 12 months, up about 170% from the identical interval a 12 months earlier. Partly resulting from greater rates of interest because the Federal Reserve tightened financial coverage, the price of servicing US authorities debt jumped 25% to an 11-year excessive of $652 billion.

On Monday, the Treasury Division boosted its forecast for borrowing within the July-September interval to $1 trillion, greater than some analysts anticipated and much greater than the $733 billion it projected in early Might.

‘puzzled’

“The overwhelming majority of economists and market analysts taking a look at this can probably be perplexed by the acknowledged causes and timing,” El-Erian wrote in a Twitter publish, rebranding the social media platform as X. It’s more likely to be excluded from having a long-lasting, disruptive impact on the US financial system and markets.”

The rapid response of economic markets in Asia was comparatively muted. Treasury bonds rose as the choice reversed the demand for safe-haven debt issued by the world’s largest financial system. The greenback rose in opposition to most main currencies, whereas US inventory futures fell.

“completely absurd”

“Fitch underestimates america, a call that has been extensively and accurately derided,” Paul Krugman, Nobel laureate and New York Occasions columnist, posted on Twitter. “There’s definitely a narrative behind this – however no matter it’s, it’s… A narrative about Fitch, not concerning the solvency of america.”

Jason Furman, a professor of the observe of economics at Harvard College and previously chief financial adviser to President Barack Obama, mentioned Fitch’s resolution was “completely ridiculous.”

Furman wrote in a Twitter publish, noting enhancements in key Fitch metrics reminiscent of macroeconomic efficiency and the US debt-to-GDP ratio.

Addressing the criticism, James McCormack, world head of sovereign and cross-national scores at Fitch Rankings, mentioned the downgrade was based mostly on the medium-term fiscal outlook for america, “characterised by rising authorities deficits and debt,” and never expectations of a attainable recession, he wrote within the paper. Electronic mail response to questions.

“In our view, US monetary metrics will evaluate much less favorably with their ranking friends within the interval forward, and we’re not assured that coverage measures will likely be accredited and carried out to handle the monetary decline,” McCormack wrote.

— With help from James Meagher and Gil Desis.

(Updates on incapacity particulars from sixth paragraph).

Most Learn from Bloomberg Businessweek

© 2023 Bloomberg LP