(Bloomberg) — Uber Applied sciences Inc reported its first-ever working revenue, however shares fell as Wall Avenue questioned whether or not the corporate may keep the tempo of progress in its ride-hailing and supply enterprise.

Most Learn from Bloomberg

Uber reported second-quarter GAAP working revenue of $326 million and free money circulation of $1.14 billion. Complete income jumped 14% to $9.2 billion in the course of the interval, beating the $9.3 billion forecast that analysts had. It was the slowest progress price because the first quarter of 2021.

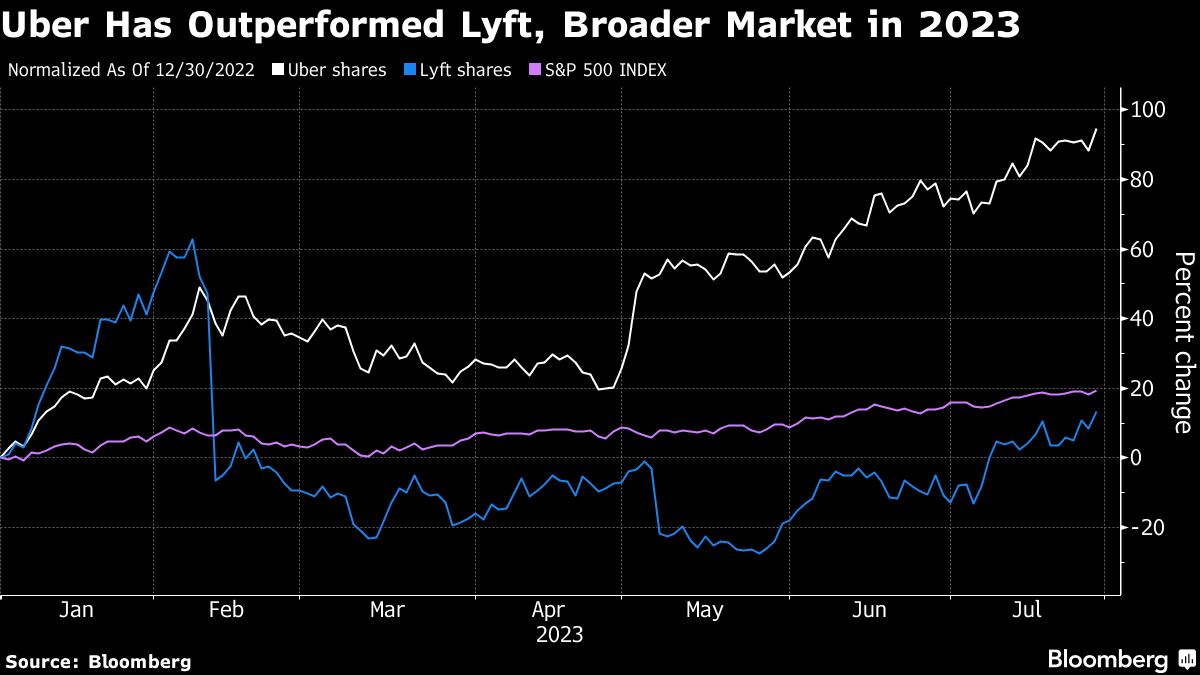

Shares, which have doubled this yr, fell 5.1% to $46.97 in New York on Tuesday morning.

“The market doesn’t consider that Uber can maintain earnings progress at these ranges,” stated Mandeep Singh, analyst at Bloomberg Intelligence.

The outcomes raised the bar for Uber sooner or later. Uber’s enterprise has remained largely unscathed from excessive inflation as clients are nonetheless keen to pay a premium for the comfort of being greeted and having meals delivered to their door. Flights within the US and Canada have recovered to pre-pandemic ranges, whereas supply demand is at an all-time excessive, regardless of rising meals prices.

After struggling a driver scarcity that brought about costs and wait occasions to extend, Uber stated the variety of lively drivers rose 33% within the second quarter in comparison with a yr in the past. The variety of flights taken rose 26% from the earlier yr to a file excessive.

Uber has centered on including new options and merchandise to the app, together with a teen trip program, the flexibility to ebook group and visitor rides, present video messaging and a ship service. The corporate has additionally expanded promoting on the app and stated it was being disciplined in managing prices “throughout the board.” The corporate has prevented the wide-ranging layoffs which have plagued many different tech firms in latest months, although it has made restricted cuts to its delivery and human sources unit. Uber was compelled to downsize considerably in 2020, when it fired a few quarter of its workforce on the top of the pandemic.

The working revenue, the corporate’s first since its founding in 2009, helped propel Uber to a shock web earnings achieve within the quarter. Uber has beforehand reported quarterly web earnings typically, but it surely’s at all times been pushed largely by funding features, as occurred once more within the second quarter. Within the three months ended June 30, Uber generated web earnings of $394 million, far exceeding the $49.2 million loss that analysts had anticipated.

Uber forecast gross bookings of $34 billion to $35 billion within the present quarter and adjusted EBITDA of $975 million to $1 billion, each of which beat analyst expectations.

“These accomplishments have been achieved by a mix of disciplined execution, file viewers and robust engagement,” CEO Dara Khosrowshahi stated in ready remarks. He added that the corporate is “effectively positioned to keep up sturdy and rising profitability”.

The corporate additionally introduced that Chief Monetary Officer Nelson Chai will probably be stepping down efficient Jan. 5, marking one of the vital high-profile departures because the firm went public in 2019. A alternative is underway.

“Once I joined the corporate in 2018, Dara requested me to guide the corporate’s monetary transformation,” Chai stated in an announcement. “As you’ll be able to see from our second quarter outcomes, that turnaround has occurred. I am very pleased with the good job we have all finished and thank Dara for his partnership.”

Shares of San Francisco-based Uber diverged sharply from Lyft Inc. , which has struggled to completely recuperate from the consequences of Covid-19. In contrast to Uber, Lyft solely operates in North America and doesn’t have a meals supply unit. Earlier this yr, Uber’s crosstown rival appointed a brand new CEO and lower costs to stem market share losses for Uber. Uber accounted for 74% of shopper share gross sales within the US on the finish of June, whereas Lyft had 26%, based on Bloomberg Second Measure. Lyft shares fell lower than 1% in pre-market buying and selling. The corporate is scheduled to announce the outcomes subsequent week.

On a convention name with analysts, Khosrowshahi stated Uber’s costs in the course of the quarter have been “comparable” to Lyft’s. The 2 are in a “constructing” market, Khosrowshahi stated, including that Lyft is “a powerful competitor that’s now competing successfully. We consider the US will probably be a two-player marketplace for some intervals to come back.”

When the pandemic crushed demand for rides, Uber’s resolution to concentrate on Uber Eats helped it achieve a foothold in a meal supply phase that has continued to develop, at the same time as indoor eating resumed. Uber Eats earned $3.06 billion, simply in need of Wall Avenue’s estimate, however Ebitda adjusted higher than anticipated at $329 million because the unit benefited from promoting. Prospects didn’t seem like hampered by greater meals costs, with supply frequency of 4 month-to-month orders per eater, up 8% from the earlier yr.

Uber generated $33.6 billion in complete bookings, which embody ride-hailing, meals supply and freight. That was a 16% improve from the earlier yr and the $33.5 billion that Wall Avenue had forecast.

Uber’s freight unit impacted the corporate’s general outcomes. The division, which accounts for lower than 1 / 4 of complete income, noticed bookings and gross sales decline by 30% within the quarter. Uber stated the unit is being pressured by “category-wide headwinds,” with spot costs weakening seasonally, a pattern it expects to proceed within the close to time period.

(Updates are shared within the third paragraph. An earlier model of this story corrected a typo within the Uber identify within the first paragraph.)

Most Learn from Bloomberg Businessweek

© 2023 Bloomberg LP